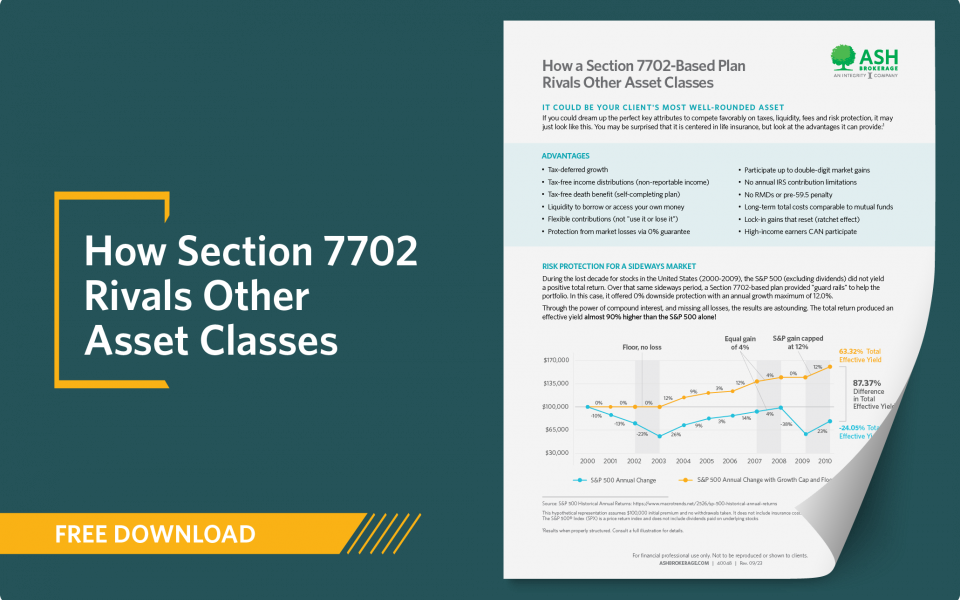

Life insurance may be your client's most valuable asset class. It has tax-deferred growth, tax-free income and a tax-free death benefit, with no annual IRS contribution limits or RMDs. See how you can position the benefits to lock in gains in a sideways market.

This piece is part of our foundation on how to leverage the benefits of cash value life insurance for tax-efficient income planning. If IRC Section 7702 rings a bell, it's because it is the tax code that allows life insurance retirement plans (LIRP) to have tax-free benefits.