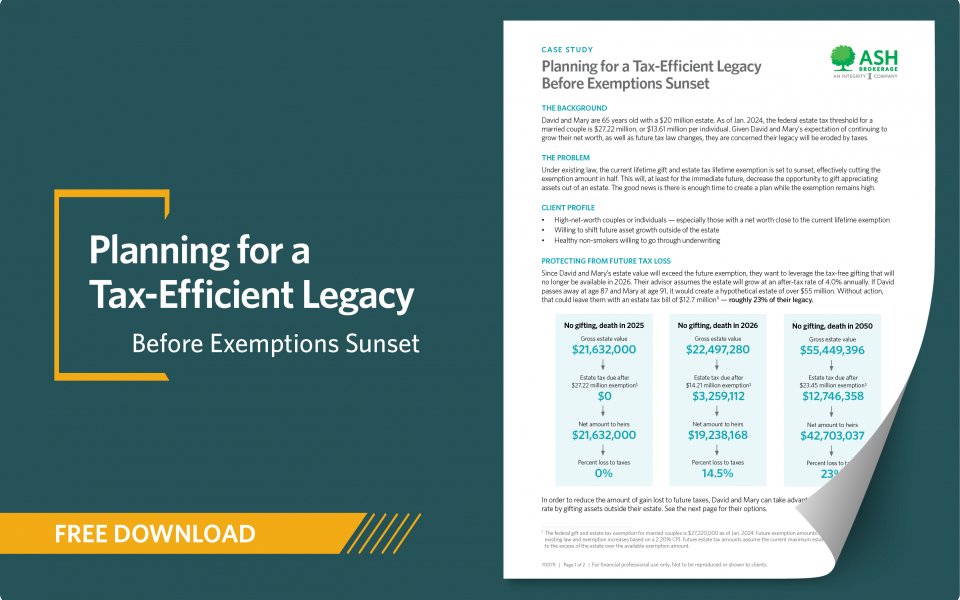

Currently, an estate is not subject to the federal estate tax until it exceeds $13.61 million (double for married taxpayers). In 2026, the current exemption will sunset, effectively cutting the amount in half. This piece looks at four options to protect your client's legacy before that happens.