We give you solutions in a soundbite. These short videos will help you break down complex topics into ideas simple enough that you can start a piece of the conversation – with your clients or our team. Browse the library then contact us to go deeper on how to apply an insurance solution to your business.

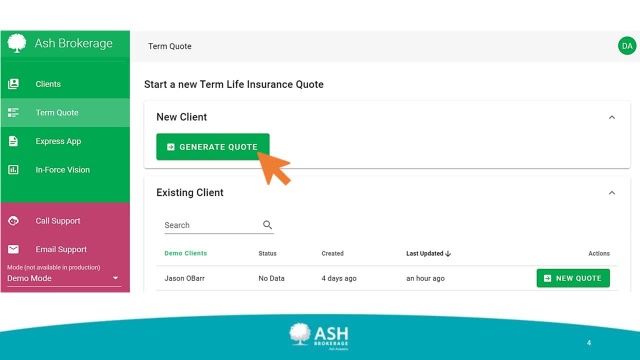

Running a Quote

Ash Express takes the guesswork out of term quotes. Using insights about health guidelines and underwriting programs, we make it easy to identify the best match in every situation. And, you can save your quotes for quick retrieval.

|

2 minutes

|

Share Video

Life Insurance

Success with the Annuity Arbitrage Strategy

A proven strategy that only gets better as rates go up? We have the solution for you and your high-net-worth clients. With the Annuity Arbitrage Strategy, those clients could have a higher yield on their fixed income instruments, while also providing an estate tax-free death benefit.

|

3 minutes

|

Share Video

Long-Term Care

Finding Funding for LTC - Idle Assets

If clients want to self-fund long-term care, discuss transferring the risk to an insurance company by repositioning existing assets that are no longer meeting their needs. That may include cash value life insurance policies, CDs, money market accounts, or annuities taking RMDs

|

3 minutes

|

Share Video

Disability Insurance

Protecting Business Owners from Disability

Your business owner client is ready to grow. Maybe start an expansion, or bring on a new partner. With a business overhead expense (BOE) DI policy or a business loan protection (BLP) rider, you can provide a safety net in case they get disabled along the way.

|

3 minutes

|

Share Video

Medicare Solutions

Medicare Solutions Referral Program

Let Ash handle your Medicare cases from start to finish ... and still get paid. Refer your clients to us and we will speak with them directly — providing the right product to solve their needs and then handling the application paperwork.

|

1 minutes

|

Share Video

Advanced Planning

Serving Up an Alternative for a Buy-Sell Agreement

In this recent success story, hear how life insurance, when properly structured, can fund a buy-sell agreement. With a business continuation general partnership buy-sell plan, you can serve clients’ retirement needs in the future, while serving the buy-sell now.

|

2 minutes

|

Share Video

Life Insurance

Life Insurance Paired with Estate Planning

We’re looking at the final installment of our three-part series on estate planning and the value of life insurance. By providing value in liquidity, and as an income tax-free death benefit, life insurance has substantial benefits when proactive measures are taken in planning.

|

4 minutes

|

Share Video

Long-Term Care

Finding Funding for LTC - Qualified Assets

Qualified accounts CAN be used to fund long-term care. Really. Many clients have qualified accounts such as IRAs, 401(k)s or other retirement accounts funded with pre-tax dollars. Some linked-benefit products can be funded by qualified funds while minimizing the tax impact.

|

4 minutes

|

Share Video

Life Insurance

Accumulating Cash Value with Estate Planning

This solution focuses on the second segment in our three-part series to estate planning. Building on the complexity, we're implementing case studies in alignment with strategies to provide significant improvement and flexibility to leave a legacy.

|

4 minutes

|

Share Video

Advanced Planning

Implementing Strategies for Key Person Plans

Your highly compensated employee clients may be significantly underinsured. This successful strategy for key employee retention is in addition to group benefit packages already being offered for all employees.

|

2 minutes

|

Share Video

Long-Term Care

Finding Funding for LTC Using Nonqualified Assets

While there are a lot of ways to fund long-term care, they all have pros and cons. So it's about finding the best fit for your client. Using an annuity to fund LTC is often overlooked. But it can carry tax advantages while creating added leverage.

|

3 minutes

|

Share Video

Retirement Solutions

Understanding Registered Index Linked Annuities

Registered Indexed Linked Annuities — or RILAs — combine features from both indexed and variable annuities — offering market-linked growth potential while mitigating the risk of downturns. See when they might be a suitable solution and how they work.

|

4 minutes

|

Share Video