Everyone thinks they're healthy, but many clients will not qualify for Preferred pricing. Don’t create a false expectation based on a best-case scenario! Sell long-term care the smart way — by letting your client provide medical and health history details directly to Ash Brokerage through a secure, digital process.

Schedule a 30-minute virtual meeting with our Onboarding team. We'll get your account set up and help you send your first LTC PreView questionnaire to yourself or a client.

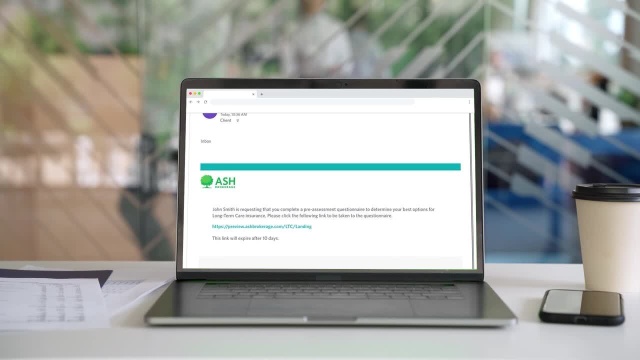

A free account on the Ash Brokerage Advisor Portal is required to access LTC PreView.

You can access LTC PreView on the Portal homepage from the Tools menu. You can also send a test PreView to yourself to review the process before using it with your clients.

Stop looking for the perfect client and start looking for perfectly set expectations!

For financial professional use only. Not to be reproduced or shown to clients.

There are multiple ways to insure for long-term care needs. Options vary and some are less expensive than others, but may offer fewer guarantees. A financial professional can work with you to determine what coverage is right for you and how much coverage you should purchase. Health insurance doesn’t cover long-term care expenses. Medicare will cover some long-term care costs, but only up to 100 days (after a 3-consecutive-day stay in a hospital under treatment). Medicaid will cover long-term care expenses for individuals with assets of $2,000 or less (varies by state) and covered care may be limited to a nursing home. Paying for long-term care costs out of pocket may not be practical or cost-efficient for many people.